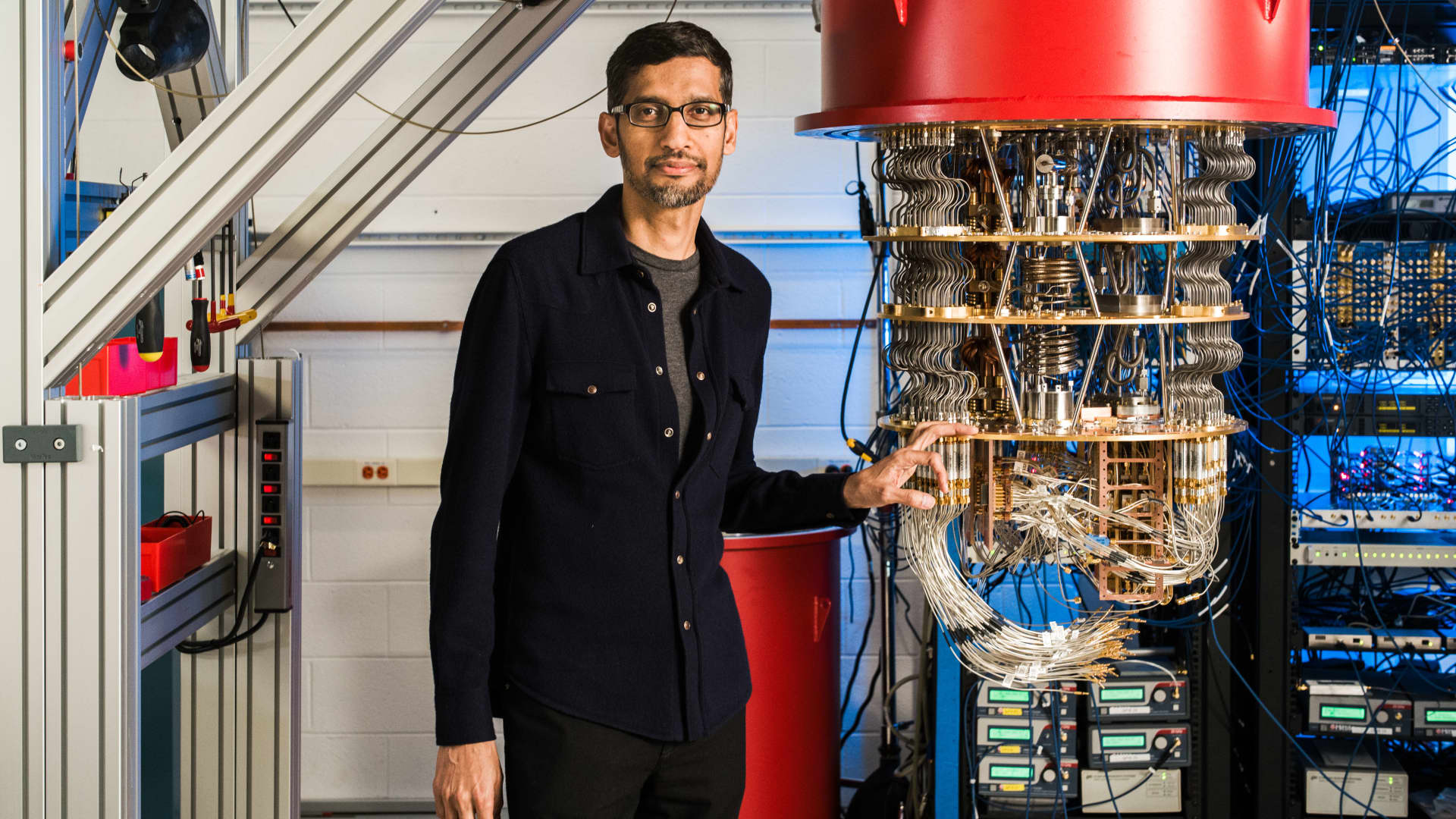

The stark warning came from one of the tech world’s most prominent CEOs. Sitting before an audience at the World Economic Forum in Davos, Switzerland, three years ago, Alphabet CEO Sundar Pichai said quantum computing has the power to transform humanity’s understanding of the natural world, enabling scientists to create new drugs and better batteries, among other advances. But with that great promise comes peril: A commercially viable quantum computer is widely expected to be able to penetrate the encryption techniques that secure the world’s financial and communications networks. “The potential is huge, but we will have challenges,” Pichai said. “In a five- to 10-year timeframe, quantum computing will break encryption as we know it.” After decades of incremental progress in quantum computing, a group of tech giants and startups are on the cusp of beginning to commercialize it. As more pure-play quantum firms become publicly traded companies, investors would do well to at least monitor the burgeoning field, which analysts expect has the potential to disrupt the technology world, creating billions of dollars of value in the process. Since its conceptual birth in the early 1980s, quantum computing has held promise for systems that could exponentially outperform today’s computers. Rather than leaning on the zeroes and ones of classical computers, quantum computers emerged from quantum physics, which is the study of the fundamental building blocks of matter and energy. The laws of quantum mechanics allow the tiniest of particles to exist in multiple states at the same time. So unlike the binary bit of regular computers, the quantum bit, or qubit , can simultaneously be a combination of zero and one, as well as any value in between. Those strange properties account for the technology’s potentially explosive abilities; each additional qubit doubles a quantum computer’s power. Quantum leaps The race to achieve a working quantum computer capable of solving problems beyond the reach of today’s computers heated up in 2019. That’s when researchers at Alphabet’s Google division claimed a breakthrough : They said their 54-qubit machine known as Sycamore performed a task in minutes that would take traditional supercomputers 10,000 years. Not to be outdone, IBM announced in May that it plans on delivering a 4,000-qubit computer by 2025 . While industry observers say the threshold for widespread commercial use would be a 100,000-qubit machine, IBM claims its quantum computer will be able to start addressing some of the more basic problems the technology is supposed to solve, including portfolio optimization for financial firms. Though still in its infancy, the market for quantum computing hardware and services will grow at a 50% compound annual rate from $475 million last year to roughly $2.5 billion by 2025 and $19 billion by 2030, according to Cowen analysts. Cowen’s Krish Sankar likened the nascent field of quantum companies to early-stage biotech firms where it’s “hard to forecast when the drug takes off.” Many of the companies are using different strategies for tackling the problem of scaling up in qubits. “Nobody knows which is going to work; maybe they all do,” Sankar said. “Most of them have a timeline in the next three to five years to get enough qubits” for commercialization, he added. Since the next-generation computers are expected to be able to simulate chemical reactions on a molecular scale, allowing for leaps in material science and drug creation, it is pharmaceutical, chemical and automotive companies that stand to be among the first sectors to benefit. But that computational power brings risks, as referenced by Alphabet’s Pichai. Quantum computers are expected to be able to solve the mathematical problems that underpin much of today’s encryption techniques, exposing the security of websites and email, for instance. That could threaten global financial and technology firms and pose a risk to cryptocurrencies, potentially allowing hackers to steal bitcoins, for instance. That has spurred investment and greater awareness among corporate executives. For instance, JPMorgan Chase has built an internal team of scientists to, among other things, help spur the development of next-generation communication networks that are safe from the quantum threat. Almost 40% of large corporations are expected to start their own quantum projects by 2025, according to research firm Gartner. Given the prohibitive expense and bulky size of quantum computers, most companies are expected to tap the technology via the cloud, analysts say. Interest in the futuristic technology — which typically requires maintaining large hardware rigs at super-cold temperatures — has exploded in recent years as venture capital investors pour money into the sector. Startups focused on quantum tech received $1.4 billion in funding last year, double the industry’s haul in 2020, according to McKinsey. Still, the nascent sector has been hammered this year in the tech rout. Several of the public quantum companies took advantage of last year’s window for smaller, unprofitable companies to list via SPAC transactions. But all of them are currently trading below their listing prices and are out of favor with investors who now prioritize profits over growth. The influx of money and growing coverage of the technology has generated a backlash. It’s unclear if a “large scale, fault tolerant” quantum machine will ever be built, Oxford University physicist Nikita Gourianov wrote in an August op-ed . According to Gourianov, quantum computers are an overhyped bubble without practical applications. Among their challenges, the computers are extremely sensitive to environmental disturbances that corrupt its information, making them highly error prone. A numbers game But there are two reasons that quantum computing should overcome its technical challenges, according to Konstantinos Karagiannis , a quantum-computing specialist at consultant Protiviti. Quantum computers will be able to compensate for bad qubits (caused by infinitesimal amounts of heat or electromagnetic fields) through a technique called ” error correction ,” he said. On top of that, bigger quantum computers will be made by connecting smaller modules, he added. “I’ve seen some amazing advancements in qubit fidelity,” Karagiannis said in an interview. “We don’t need perfect qubits, we need them to be really good, and then we need enough of them to do what’s called error correction.” While more than 200 quantum-related companies exist today, just four of the so-called pure plays are publicly traded, according to Bernstein. They are named D-Wave Systems , Rigetti Computing, IonQ , and Quantum Computing. Cowen recommends Berkeley, California-based Rigetti Computing , which develops circuits for quantum computers and offers a cloud platform that enables engineers to design quantum algorithms. The 9-year-old company, founded by a former IBM physicist, is “well positioned” to benefit from the adoption of quantum computing as a service, according to Cowen. Quantum Computing focuses on software solutions for businesses and is buy rated by Ascendiant Capital Markets’ Edward Woo, who expects “strong growth” over the next year as the company ramps up marketing. “By being early in this rapidly growing industry, we believe Quantum is well positioned to capture and drive a meaningful market share,” Woo wrote in a recent note raising his price target on the Leesburg, Virginia-based firm to $9.50. The stock has declined 33% this year and last closed at $2.27, implying a 319% gain if Woo’s target is met. Other firms that will capture revenue from quantum computing include Applied Materials and MKS Instruments, according to Cowen. Applied Materials, which supplies equipment for makers of semiconductors and displays, will benefit from rising demand for superconducting chips, Cowen said. MKS , a supplier for semiconductor manufacturers and advanced electronics, can supply the industrial lasers needed in various quantum rigs. Still, even its boosters concede that the adoption of quantum computing could be a bumpy journey for investors, given the speculative nature of the field and the unknowns around commercialization. A more conservative way to play the sector could be through owning established big tech companies. Alphabet and IBM are poised to be major players in quantum computing, if their investments are any indication. Last year, Alphabet’s Google announced a multibillion-dollar plan to build a commercial-grade quantum computer by 2029, aided by its new quantum campus in California. Meanwhile, IBM has made among the biggest commitments to quantum, with several hundred employees, more than 20 quantum computers and a cloud service with more than 360,000 users. Last year, Microsoft launched its cloud service Azure Quantum , a full stack offering that allows customers to access quantum hardware and software. The tech giant has eight quantum computing labs around the world and is working on developing its own quantum computer relying on a potentially more stable form of technology. Quantum supremacy The efforts from large, well-financed companies as well as startups bode well for the industry. So-called quantum supremacy — the moment when quantum computers are able to reliably perform calculations far beyond the scope of traditional supercomputers — could happen by decade’s end, according to JPMorgan’s Marco Pistoia , a quantum expert who spent most of his career at IBM. “Even now that quantum computers are not yet that powerful, we don’t have so much time left,” Pistoia said in a podcast . Corporations need to prepare for that moment now or risk falling behind, he said. That progress offers others encouragement. “We’re seeing these milestones happening, so I’m certain we’re going to get there,” Karagiannis said. “The machines are getting really, really good.”

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from Investing – My Blog https://ift.tt/cJ6g93E

via IFTTT