Michael Vi

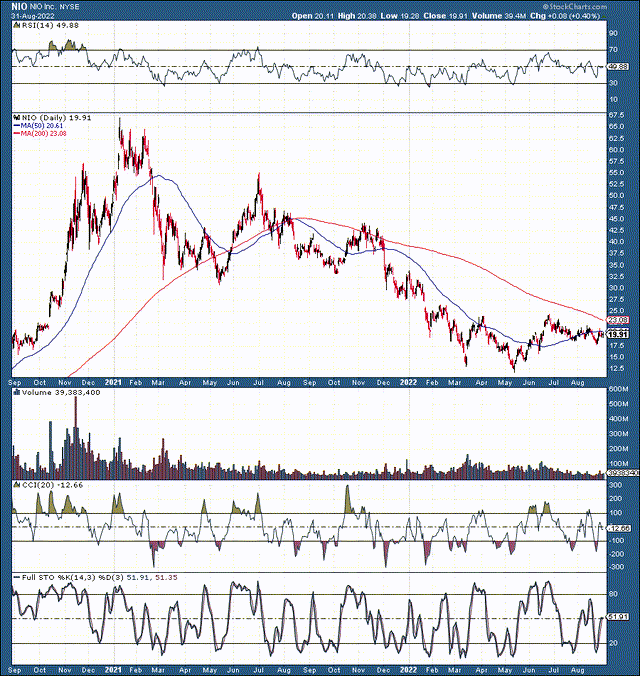

NIO Inc.’s (NYSE:NIO) stock has been heading in reverse lately. Despite being one of the most exciting and promising 100% electric vehicle (“EV”) manufacturers worldwide, NIO’s stock is down by 70% from its all-time high. NIO’s stock has been battered for several reasons. The most basic explanation is that NIO is a Chinese company and Chinese stocks are out of favor. However, with an auditing deal approaching, NIO’s stock should take off again.

NIO 2-Year Chart

NIO (StockCharts.com )

Moreover, NIO put up a record quarter in July, illustrating great demand for the company’s vehicles. NIO should report Q2 numbers on September 7th. Analysts’ (consensus) estimates are for $1.41 billion in revenues and a GAAP loss of 20 cents, but the company can report better, in my view. Furthermore, due to the favorable market dynamics, NIO should continue surpassing consensus analysts’ expectations as the company advances in the coming quarters. Diminishing uncertainty, improving growth, and expanding profitability should drive NIO’s share considerably higher in future years.

Addressing The Delisting Concerns

Many investors get a chill down their spine when mentioning a Chinese company. Many prominent Chinese stocks (including NIO) have crashed over the last two years due to delisting concerns and other uncertainties. Chinese stocks were widely held due to their ability to expand revenues rapidly, produce profits, and show substantial growth. However, due to the delisting hysteria, many market participants won’t touch Chinese companies with a ten-foot pole. It’s not only about delisting. Other factors like a slowdown in China, profit decreases, concerns over China’s government intervention, geopolitical events, and other factors have contributed to the reduced popularity of Chinese stocks. However, these uncertainties are transitory elements, and the big problem remains the delisting concerns.

So, let’s address the possibility of the delisting issue. The delisting concern applies to NIO about as much as it does to any prominent Chinese stock. Baidu (BIDU), Alibaba (BABA), Pinduoduo (PDD), and many other quality Chinese companies trade at low valuations because of the delisting risk. However, Chinese companies trade at significant discounts to their American counterparts and offer remarkable growth opportunities. Perhaps most importantly, the delisting fears are probably overblown.

Washington and Beijing are close to an agreement, allowing U.S. regulators access to audits of Chinese companies listed on American exchanges. The crucial uncertainty suppressing NIO’s valuation, market cap, and stock price is the possibility of delisting due to auditing issues between the two economic superpowers. I’ve long written about the unlikelihood of mass delistings due to undesirable consequences for the Chinese economy and the country’s government. Moreover, worsening economic relations is not in the U.S.’s interest as the two countries have an extensive financial and trading relationship. Therefore, we should continue seeing progress concerning the auditing deal, and NIO’s shares should go much higher when an agreement is achieved. The stock can double on the news of an auditing agreement being reached.

NIO’s Remarkable Potential

Another factor being underestimated is NIO’s massive potential. NIO is expanding with its first plant in Europe, looking to deliver battery swapping stations and other power products to NIO customers, speeding up expansion in countries like Germany, Sweden, the Netherlands, and others. NIO is also partnering with Shell (SHEL) to build battery swapping stations globally, starting in China and Europe this year. While NIO is gaining traction and establishing its infrastructure in Europe, the company has enormous prospects in its domestic market.

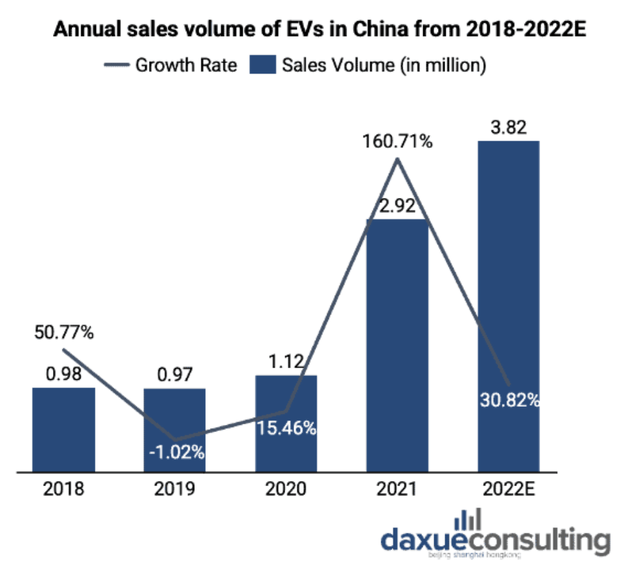

China EV Market

China EV (daxueconsulting.com)

China is the most significant EV market in the world. It’s estimated that nearly 4 million passenger EVs will be sold in China this year, approximately a 31% YoY increase. About 21.5 million passenger vehicles were sold in China last year.

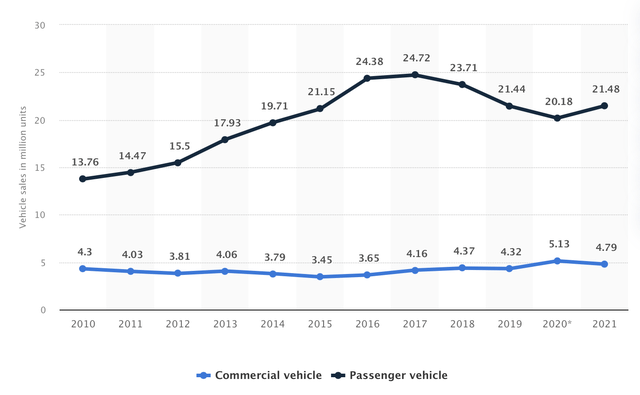

Vehicle sales in China

China car sales (Statista.com)

We see that EVs account for nearly 18% of total passenger vehicle sales, a substantial percentage that should continue rising in the coming years. Moreover, China accounts for a whopping 32% of the global passenger vehicle market. The remarkable growth dynamic in the most prominent car market in the world (NIO’s domestic market) should provide NIO with tremendous growth opportunities for many years as the company advances.

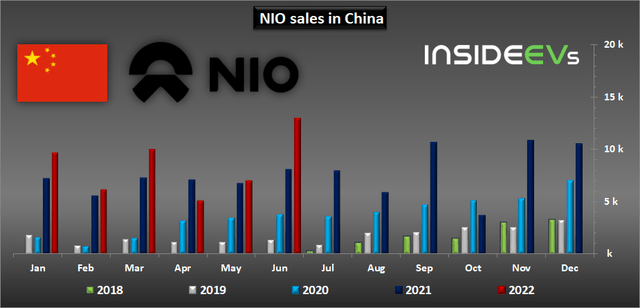

NIO – Record Sales

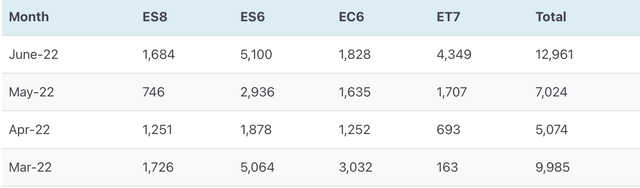

NIO sales (insideevs.com)

NIO achieved record sales in June (60% YoY), delivering nearly 13,000 vehicles to its customers in one month. Moreover, we see spectacular growth, as the company is in its fifth year of shipping high-end performance EVs. If you are worried about low sales in April and May, it’s because of the coronavirus lockdowns, and should be a transitory event that’s passed. More importantly, NIO followed up with another robust quarter in July, delivering more than 10,000 vehicles and illustrating 27% YoY growth. Last quarter NIO delivered 25,059 vehicles, significantly above its guidance of 23,000-25,000 cars. Through July 31st, 2022, NIO has delivered approximately 228,000 vehicles cumulatively.

The ET 7 – The Market Has Been Waiting

NIO sales (cnevpost.com)

The ET 7, NIO’s luxury sedan model, recently went on sale. We see rapid growth, and the ET 7 now represents a significant percentage of total vehicle sales for NIO. The ET 7 is a superb vehicle that can deliver 620 miles of range on a single charge. The full-size sedan can go 0-60 in less than four seconds and starts at only $69,000. The ET 7 is well positioned to compete with Tesla’s Model S, Lucid’s Air, and other premium 100% EVs globally. While NIO’s ET 7 flagship should contribute significantly to the company’s sales, NIO’s next ET 5 vehicle should provide an explosion in revenues. The ET 5 should be released later this month, is a direct competitor to Tesla’s Model 3, and starts at only about $51,500.

NIO vs. Other EV Manufacturers

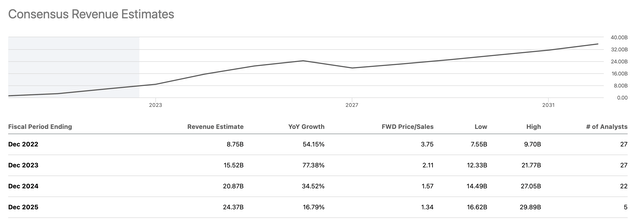

NIO’s market cap is only around $32 billion, and consensus estimates illustrate that the company’s revenues should be around $15.5 billion in 2023.

NIO Revenue Estimates

NIO revenues (SeekingAlpha.com )

However, NIO often surprises higher on revenues, and the company’s mass-market ET 5 vehicle starts selling soon. NIO has surpassed revenue forecasts in 12 out of 15 quarters, and this trend of outperformance will likely continue as the company advances. Therefore, NIO could report towards the higher end of revenue estimates, delivering $18 billion or more next year.

So, we see NIO’s stock is selling at only about 1.8-2 times forward sales estimates. In comparison, Tesla (TSLA) trades at about seven times forward sales expectations. Lucid has a market cap of about $25 billion. However, Lucid hasn’t proven much sales-wise but may deliver around $2.85 billion in revenues next year. This estimate places Lucid’s valuation at approximately nine times sales. Rivian is another starting EV that has not yet proved it can mass produce, but it trades at about five times projected sales estimates.

Thus, we see that NIO’s valuation is significantly lower than its American counterparts. Moreover, NIO’s valuation is substantially lower than companies that have not demonstrated they can mass produce effectively yet. Therefore, NIO’s P/S multiple can expand considerably as the company advances. Once we receive clarity on the auditing deal, NIO’s P/S multiple could roughly double and should extend further as the company proceeds to grow revenues and increase profitability.

What NIO’s financials could look like from here:

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Revenue Bs | $9 | $18 | $24 | $30 | $37 | $45 | $55 | $66 |

| Revenue growth | 54% | 100% | 33% | 25% | 23% | 22% | 21% | 20% |

| Forward P/S ratio | 1.78 | 2.5 | 3 | 4 | 5 | 5.5 | 5.5 | 5 |

| Market cap $ | 32b | 60b | 90b | 148b | 225b | 303b | 363b | 390b |

| Price | $19 | $36 | $54 | $88 | $134 | $180 | $215 | $231 |

Source: The Financial Prophet

We see that NIO’s stock price can go dramatically higher with mild multiple expansion and slightly higher than consensus estimated revenue growth. NIO has explosive momentum and remarkable potential, making it one of the top Chinese stocks to own. I expect NIO’s stock price to move much higher. Therefore, I have a buy rating on the stock and a 1-year price target range of $36-54, roughly a 90-185% increase over its current stock price.

Risks to NIO

Despite my bullish outlook, there are various risks to my thesis. The China delisting concerns could continue. Therefore, delisting fears and other detrimental factors related to China could continue to pressure NIO’s stock price. Also, the company could run into various production issues and may not reach the production capacity I envision in time. Moreover, NIO’s vehicles may experience a drop-off in demand, in which case the company’s share price would suffer. NIO remains an elevated risk investment, but there is substantial reward potential if everything goes right.

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from Top Stock To Invest – My Blog https://ift.tt/wtLjDn5

via IFTTT