The global economy is cooling, making growth investing intrinsically problematic. This is why I’m looking for growth investments with a high degree of safety. Consequently, MercadoLibre (MELI -4.22%) is my top growth stock to buy right now.

MercadoLibre is a safe stock, in my opinion. However, this doesn’t mean the company is free of risk. We’ll explore some of what’s gone wrong recently. But I believe you’ll agree there’s still reason to own this stock.

Why MercadoLibre stock is down more than 50%

MercadoLibre is an international stock and its biggest markets are Brazil, Argentina, and Mexico. And these economies have struggled in recent years. Bank of America just lowered its 2023 economic growth projections for Mexico from 1% growth to flat, according to Reuters. For its part, Brazil’s economy was in recession in 2021. And even though it’s officially over, the economy is still limping. Finally, Argentina’s economy was in recession from 2018 through 2020. It rebounded in 2021, but problems remain.

Despite the macroeconomic headwinds, MercadoLibre has grown its business in these countries. However, the U.S. dollar appreciated significantly in relation to local currencies, as the following chart for the Brazilian Real shows. This makes local gains look smaller when converting back to dollars.

US Dollar to Brazilian Real Exchange Rate data by YCharts

Adding to MercadoLibre’s challenges are its profit margins. For nearly a decade, its gross margin and net margin trended down. The company expanded into businesses that have a lower margin profile. And it’s also been building shipping infrastructure, which is costly.

These things have hurt MercadoLibre’s profitability, as the next chart shows. However, these investments were necessary to drive its long-term adoption — more on that in a moment. But it is suppressing the company’s profits nonetheless and keeping the stock off of value investors’ radars.

MELI Profit Margin data by YCharts

To that last point, MercadoLibre stock traded at a price-to-sales (P/S) valuation over 25 at its highs. That was historically high for this company, and it’s not surprising to see its valuation plummet back down to a much more reasonable P/S multiple of about five.

Why investors should buy MercadoLibre stock

Despite the problems, MercadoLibre has continued to grow at an impressive pace. Consider that in the first half of 2022, 107 million unique people used MercadoLibre’s services, compared to just 98 million in the same period of 2021. And even with currency headwinds, the company’s year-to-date revenue is still up an impressive 57% year over year.

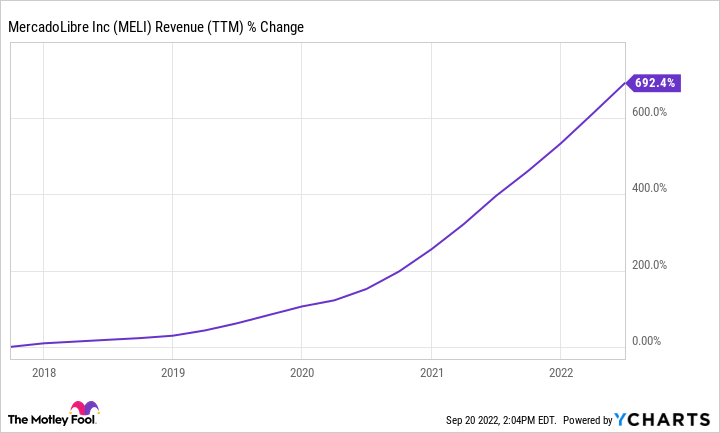

If that growth isn’t hot enough for you, consider that MercadoLibre’s trailing-12-month revenue is up nearly 700% over just the past five years.

MELI Revenue (TTM) data by YCharts

MercadoLibre is achieving such outstanding growth, in part, due to Latin American trends. Adoption of e-commerce and digital payments lagged markets like the U.S. historically. But as people start trying these things out, MercadoLibre has been able to capture the opportunity.

However, MercadoLibre isn’t just capturing the opportunity — it’s also enabling it. E-commerce and digital payments were adopted more slowly because of substantial user friction. Shipping logistics were lacking. And it’s hard to digitize predominantly cash-based societies. But MercadoLibre has done both.

To illustrate, let’s zoom in on MercadoLibre’s shipping logistics network — Mercado Envios. It shipped more than 264 million items in the second quarter of 2022. And 80% was delivered in 48 hours or less. Yes, profit margins have taken a hit to build out Mercado Envios. But its logistic capabilities make it more likely that users will ultimately adopt MercadoLibre as an e-commerce platform.

MercadoLibre’s logistics network is also really hard to compete with, especially in this economy. For evidence, consider recent actions by competitor Sea Limited (SE -3.61%). The company has its own e-commerce division called Shopee, and it was expanding rapidly in Latin America. However, doing so is expensive. And the company is suddenly concerned about cash flow because of market conditions — financing is much harder to come by now. Shopee is staying in Brazil, but it’s discontinuing local operations in various MercadoLibre markets, according to Reuters.

Sea Limited is a huge company with a $32 billion market capitalization, and yet it can’t spend and take market share because of the economy. Therefore, I’d wager every potential MercadoLibre competitor is similarly under pressure. By contrast, MercadoLibre can lean back on years of building to keep growing through this business cycle.

According to Americas Market Intelligence, e-commerce accounts for 15% of retail sales in Latin America compared to just 6% before the pandemic. Moreover, the top six markets are projected to grow e-commerce sales at double-digit compound annual growth rates through 2025.

In conclusion, this is a hot growth market. And MercadoLibre could be one of the primary beneficiaries thanks to years of diligent execution.

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Jon Quast has positions in MercadoLibre. The Motley Fool has positions in and recommends MercadoLibre and Sea Limited. The Motley Fool has a disclosure policy.

Techyrack Website stock market day trading and youtube monetization and adsense Approval

Adsense Arbitrage website traffic Get Adsense Approval Google Adsense Earnings Traffic Arbitrage YouTube Monetization YouTube Monetization, Watchtime and Subscribers Ready Monetized Autoblog

from Top Stock To Invest – My Blog https://ift.tt/0axfbsY

via IFTTT