Stocks wavered Friday in a volatile trading session after the July jobs report was much better than expected, as investors assessed what a strong labor market would mean for the Federal Reserve’s rate tightening campaign.

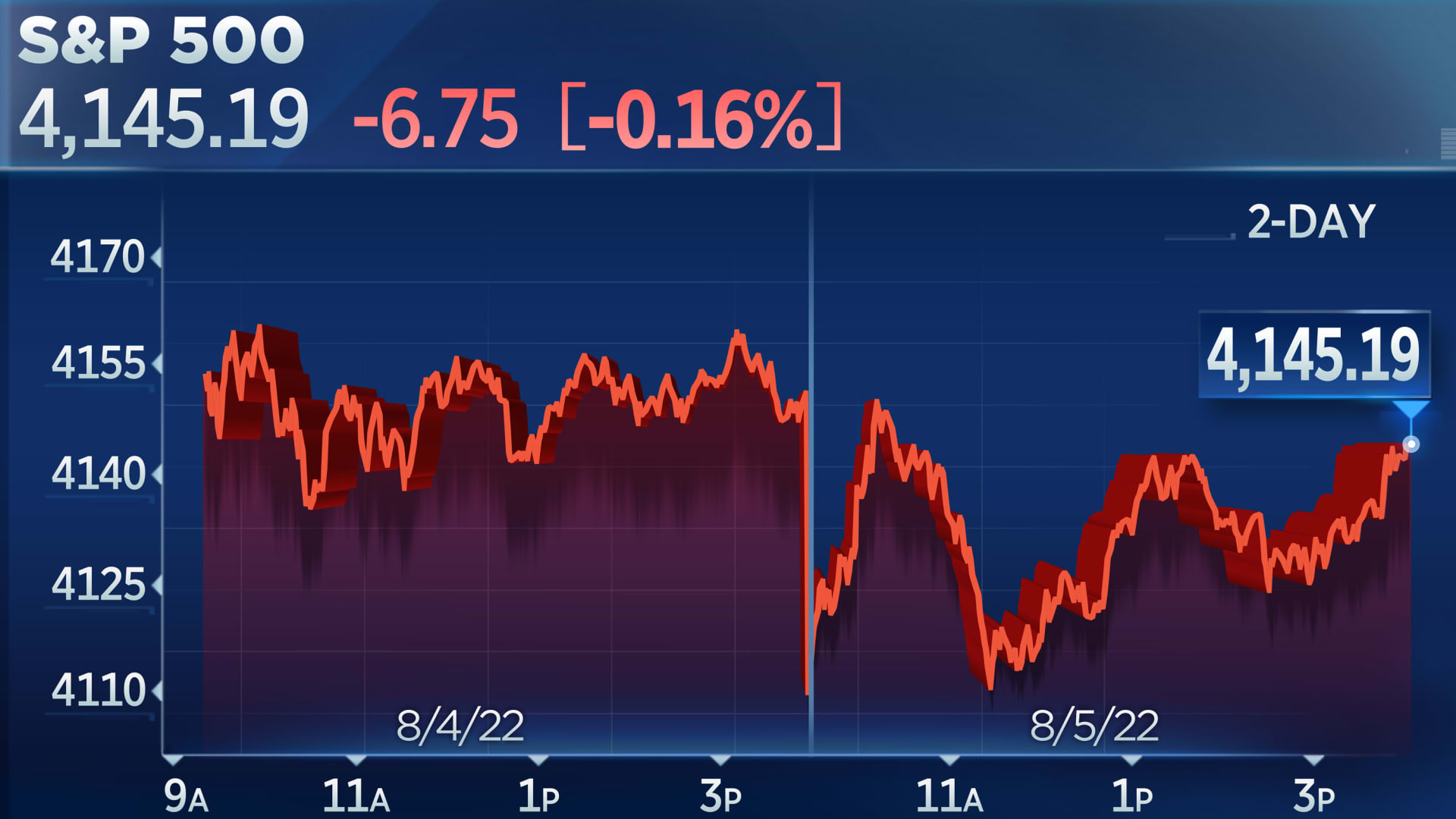

The Dow Jones Industrial Average gained 76.65 points, or 0.23%, to end at 32,803.47. Even with Friday’s gains, however, it fell on the week. The S&P 500 shed 0.16% to end at 4,145.19, and the Nasdaq Composite lost 0.50% Friday, falling to 12,657.56. Still, both the S&P 500 and the Nasdaq ended the first week of August higher.

Losses were offset by bank stocks, which rose on hopes that interest rate hikes will continue at a solid clip. Energy stocks also gained, but technology companies slumped.

The labor market added 528,000 jobs in July, easily beating a Dow Jones estimate of a 258,000 increase. The unemployment rate ticked down to 3.5%, below the 3.6% estimate. Wage growth also rose more than estimated, up 0.5% for the month and 5.2% higher than a year ago, signaling that high inflation is likely still a problem.

Stocks opened lower following the report, even as it seemed to indicate the economy was not currently in a recession. Job growth was expected to slow as the Fed continues to hike interest rates to tame inflation, but this report shows a labor market still running hot. That means the central bank may act more aggressively at its next meeting.

“Anybody that jumped on the ‘Fed is going to pivot next year and start cutting rates’ is going to have to get off at the next station, because that’s not in the cards,” said Art Hogan, chief market strategist at B. Riley Financial. “It is clearly a situation where the economy is not screeching or heading into a recession here and now.”

Friday’s jobs report is a crucial one as it’s one of two the central bank will see before it decides how much to raise rates at its September meeting. Indeed, traders are already betting on a tougher stance from the Fed. Policy makers will have another jobs report and two more consumer price index numbers to weigh before the central bank makes its next rate decision.

Major averages posted their best month since 2020 in July on the hope the Fed would slow the pace of its hikes. The S&P 500 added 9.1% last month.

from Wall Street Exchange – My Blog https://ift.tt/Ouy0fYZ

via IFTTT