Fears of a pointy slowdown are getting the blame for the inventory market’s renewed slide whereas additionally driving a retreat in Treasury yields. A have a look at a regional Fed financial institution’s carefully adopted economic-growth indicator might justify investor jitters, stated a prime Wall Road researcher.

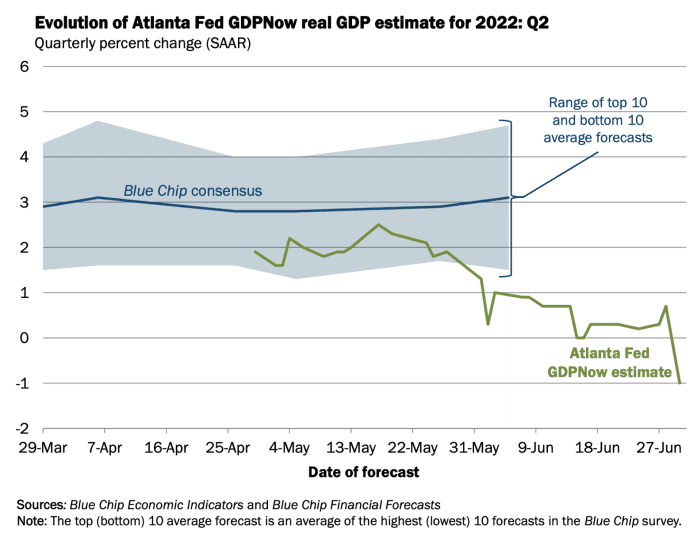

The Federal Reserve Bank of Atlanta’s GDPNow model on Friday forecast a 2.1% second-quarter fall in U.S. gross home product following a slide within the Institute for Provide Administration’s June manufacturing index and knowledge on building spending. The Atlanta Fed had lowered its estimate Thursday to -1% from an increase of 0.3% after knowledge on private consumption and expenditures, tripping alarm bells for recession-wary traders.

If the forecast is on observe, it will mark the second consecutive fall in GDP after a 1.6% contraction within the first three months of 2022.

“We’re ending Q2 on an financial low observe, which fits an extended approach to explaining why 10-year Treasury yields TMUBMUSD10Y, 2.894% have are available in so dramatically from their June 14th highs of three.48 %,” wrote Nicholas Colas, co-founder of DataTrek Analysis, in a Friday observe.

“Shares have taken no consolation from the current decline in yields as a result of they see the identical challenge portrayed within the GDPNow knowledge: a U.S. economic system that’s quickly cooling,” he stated.

The two-year TMUBMUSD02Y, 2.836% and 10-year Treasury yields fell below 3% on Thursday after hitting a 11-year high earlier this month as the percentages of a recession seemed to be rising. Treasury yields transfer reverse to cost.

The S&P 500 on Thursday closed out its worst first half performance in additional than 50 years. The massive-cap benchmark SPX, +1.06% fell 20.58% year-to-date by means of Thursday’s shut, and was down 21.08% from its report shut on January 3, earlier than bouncing 1.1% in Friday’s session. The Dow Jones Industrial Common DJIA, +1.05% fell greater than 15% within the first half.

SOURCES: BLUE CHIP ECONOMIC INDICATORS AND BLUE CHIP FINANCIAL FORECASTS

The Atlanta GDPNow is up to date in actual time as contemporary financial knowledge rolls in, utilizing a strategy much like that employed by the Bureau of Financial Evaluation in its official gross home product forecast. It’s not an official Atlanta Fed forecast, however it’s a broadly watched indicator and “essential to observe” as “it has a robust observe report, and the nearer we get to July twenty eighth’s launch the extra correct it turns into”, in accordance with Colas.

Colas famous that 28 days forward of the official BEA launch, the mannequin averages an absolute error of 1.2 factors. Seven days forward of the report, the error price shrinks to 0.8 level.

“The mannequin’s long-run observe report is great,” he wrote. “Because the Atlanta Fed first began operating the mannequin in 2011, its common error has been simply -0.3 factors. From 2011 to 2019 (excluding the financial volatility across the pandemic), its monitoring error averaged zero.”

Although a second consecutive quarter of unfavorable development of the U.S. economic system would meet a generally-used definition of recession, the National Bureau of Economic Research (NBER), the official arbiter of U.S. enterprise cycles, makes use of completely different standards. The NBER’s definition of a recession is that “it’s a important decline in financial exercise that’s unfold throughout the economic system and that lasts various months”.

Learn Extra:The Dow just booked its worst first half since 1962. What history says about the path ahead.

Shares, in the meantime, the Dow Jones Industrial Common DJIA, +1.05% climbed 255.18 factors, or 0.83%, to 31,034 on Friday afternoon. The S&P 500 was up 27 factors, or 0.72%, at 3,812. The Nasdaq Composite COMP, +0.90% elevated 63.07 factors, or 0.58%, to 11,094.

Learn Extra: Guggenheim warns U.S. economy likely entered recession during the second quarter

from Stock Market News – My Blog https://ift.tt/tGSOwUv

via IFTTT