Stocks rallied Wednesday after the Federal Reserve announced its much anticipated 0.75 percentage point rate increase to fight inflation, but hinted that it could slow the pace of its hiking campaign at some point.

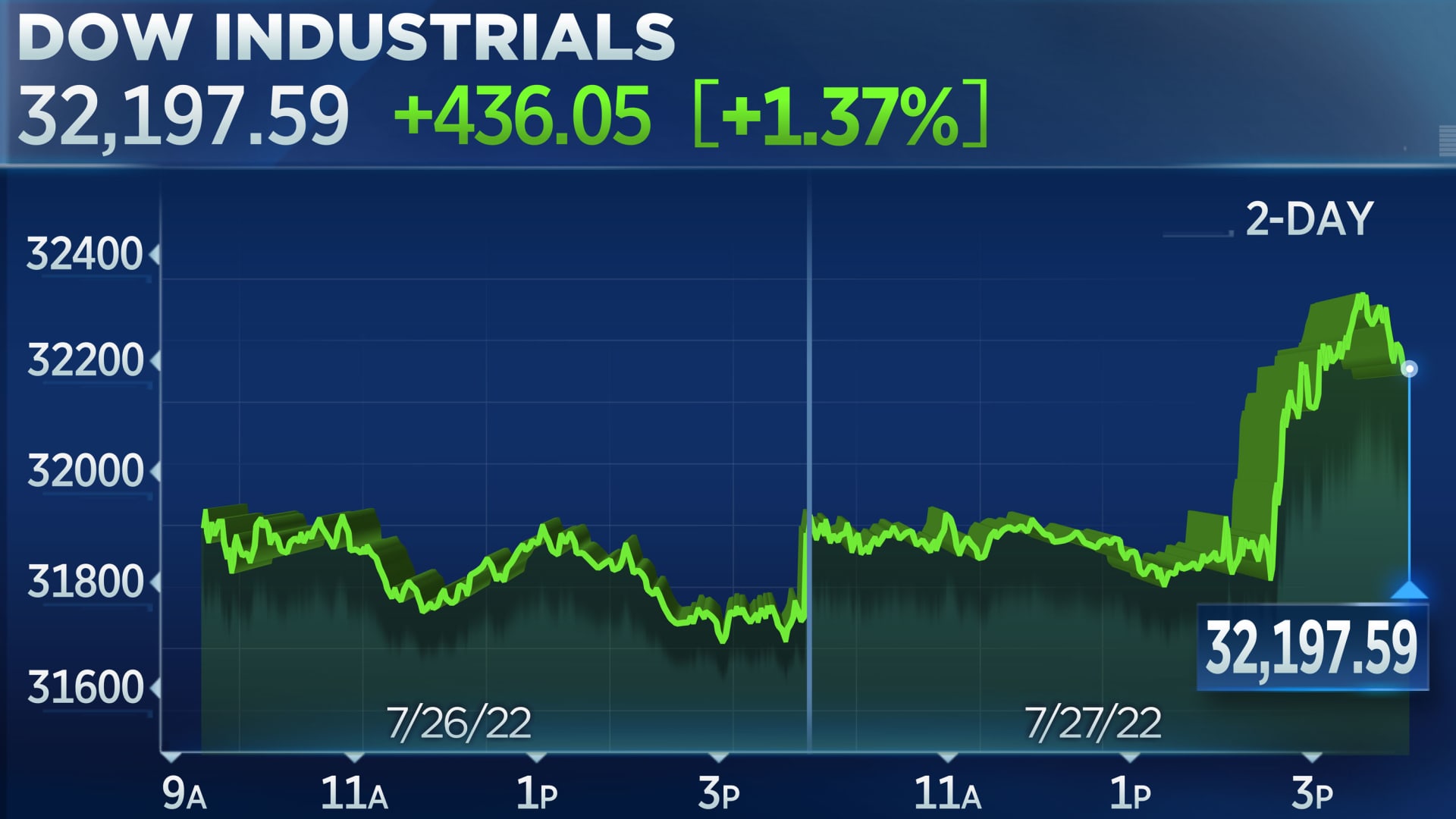

The Dow Jones Industrial Average jumped 436.05 points, or nearly 1.4%, to 32,197.59. The S&P 500 gained 2.62% to close at 4,023.61. The Nasdaq Composite climbed 4.06% to 12,032.42. Tech shares led gains a day after quarterly results from Alphabet and Microsoft.

Stocks hit their highs of the session in the afternoon as Fed Chairman Jerome Powell left the door open about the size of the central bank’s rate move at its next meeting in September and noted it would eventually slow the magnitude of rate hikes. Powell said in a press conference that the Fed could hike by 0.75 percentage point again in September, but that it would be dependent on the data.

Loading chart…

“As the stance of monetary policy tightens further, it likely will become appropriate to slow the pace of increases while we assess how our cumulative policy adjustments are affecting the economy and inflation,” he said.

Investors were also encouraged after Powell noted that he doesn’t believe the economy is currently in a recession. The second-quarter GDP reading is due on Thursday.

Investors have continued to worry that the central bank’s ongoing efforts to lower inflation will push the economy into a recession, or that we may already be in one. Those fears eased Wednesday after Powell said he does not think the U.S. is currently in a recession, adding that “there are too many areas of the economy that are performing too well.”

“The reason this is providing some relief to the equity market is the Fed is acknowledging that there can be an impact on growth to the economy based on their policy,” said Gargi Chaudhuri, head of BlackRock’s iShares investment strategy for the Americas. “They’re recognizing there are two sides of this: there’s a growth tradeoff to fight inflation. That recognition is something we had today that we didn’t hear before.”

Many regard two consecutive quarters of negative GDP readings as a recession, but the National Bureau of Economic Research, the official arbiter of recessions, uses multiple other factors to determine one. The GDP reading Thursday is expected to show barely an expansion after first-quarter GDP declined by 1.6%.

Stocks started the day on a high note after getting a boost from tech earnings. Tech stocks added to those gains as the overall market rallied.

Alphabet shares rose about 7.7% after the tech giant’s quarterly report showed strong revenue from Google’s search business. Microsoft gained close to 6.7% after reporting a 40% jump in revenue growth for Azure and cloud services. The gains came even after both companies posted earnings and revenue that fell below analyst estimates.

Meta Platforms shares rose nearly 6.6%, ahead of its earnings scheduled for after the bell. Amazon advanced more than 5% after getting hit by the retail carnage Tuesday. Apple added 3.4%.

Retailers rallied too as inflation concerns softened Wednesday afternoon. Walmart, which led retail declines in the previous session, climbed about 3.8%. Kohl’s, Ross Stores and Costco added more than 2% each. The SPDR S&P Retail ETF advanced roughly 2.6%.

Enphase Energy also popped on the back of its latest results, ending the day about 17.9% higher. Chipotle added 14.7% following its mixed second-quarter earnings release.

from Stock Market News – My Blog https://ift.tt/0DxweCU

via IFTTT