The slumping inventory market might quickly get a seasonal increase, a minimum of that’s what historical past exhibits, based on Bespoke Funding Group.

“There’s not a lot for buyers to get enthusiastic about in terms of the fairness market today, however in our seek for silver linings, the calendar is one pattern that’s beginning to work out there’s favor,” Bespoke stated in an emailed notice Monday.

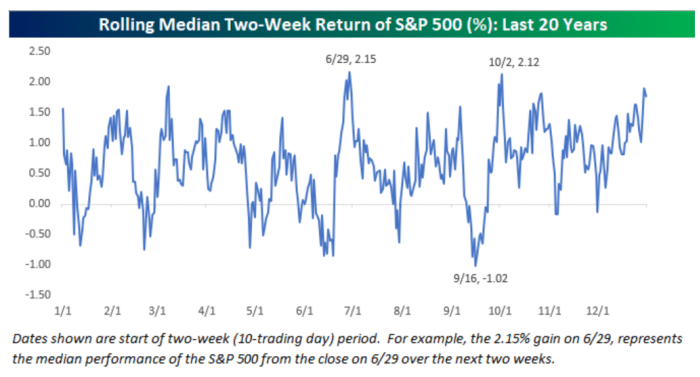

The S&P 500 traditionally performs nicely in the course of the two weeks following the shut on June 29, with its 2.15% achieve over that stretch being “the perfect of every other day on the calendar during the last 20 years,” the notice exhibits. The pattern is captured on this chart under.

The chart exhibits that Oct. 2 is the second-best day based mostly on returns seen over the next two weeks. And “the interval from the shut on 9/16 has been the weakest two-week interval on the calendar with the S&P 500 declining by a median of 1.02% during the last 20 years.”

“Seasonal patterns ought to by no means be a main foundation for any funding resolution, however it actually helps to know what the seasonal tendencies are at totally different instances of the 12 months and due to this fact is a subject we take note of,” Bespoke wrote. “If there’s ever a time that buyers might use a seasonal pick-me-up, it will be as we shut out the worst first half for the market in over 50 years!”

The S&P 500 SPX,